If published, the 2022 tax year PDF file will display, the prior tax year 2021 if not.

Form 1040X and the 1040X instructions booklet are generally published in February of each year by the IRS. Virgin Islands, or the Northern Marian Islands, See Pub. Form 1040X is a multi-year form which can be used for income tax years 2022, 2021, and 2020. * If you live in American Samoa, Puerto Rico, Guam, the U.S. The program will proceed with the interview questions for you to complete the amended return. On smaller devices, click in the upper left-hand corner, then click Filing. possession or territory * or use an APO or FPO address, or file Form 2555, 2555-EZ, or 4563 or are a dual-status alien. To complete the amendment process for your Federal return: From within your TaxAct return ( Online or Desktop), click Filing to expand, then click Amend Federal Return. Form 1040-X filing addresses for Taxpayers and Tax Professionals If you live in:Ĭonnecticut, Delaware, District of Columbia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, WisconsinĪlabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Oklahoma, TexasĪlaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Michigan, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, WyomingĪ foreign country, U.S.

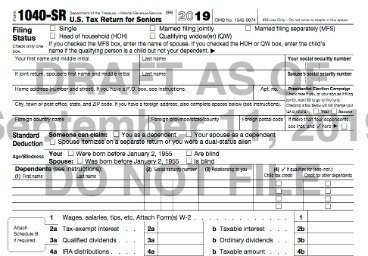

Complete Form 1040-X: Add your personal information, details of whats.

TURBOTAX 1040X EFILE 2020 DOWNLOAD

Savings and price comparison based on anticipated price increase. Download Form 1040-X from the IRS website. E-file fees may not apply in certain states, check here for details. 1040NR and 1040NR-EZ filers will not be able to e-file amended returns. Individual Income Tax Return, Form 1040-X, to claim the credit.The IRS will not calculate the 2020 Recovery Rebate Credit for you if you did not enter any amount on your original 2020 tax return. ProSeries will not support e-filing an amended 1040-SR. Yes, if your 2020 has been processed and you didnt claim the credit on your original 2020 tax return, you must file an Amended U.S. Additional fees may apply for e-filing state returns. Only an e-filed Form 1040 or 1040-SR can be amended this way due to IRS limitations. Before you amend: amend only if you need to make a change on a return you have already filed. To start your amended return, go back into TurboTax, open the return that you already sent in, and on the first page you see, click on the link to amend your return. Do not file a second tax return or contact the IRS about the status of your return.

TURBOTAX 1040X EFILE 2020 FREE

These Where to File addresses are to be used only by taxpayers and tax professionals filing Form 1040-X during Calendar Year 2023. TurboTax CD/Download Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. If you want to amend your return from a prior year, use that year’s version of TurboTax. If you already filed a paper return, we will process it in the order we received it.

0 kommentar(er)

0 kommentar(er)